Filing advance taxes in India involves a few steps to ensure compliance with the Income Tax Act, 1961. Here's a detailed guide:

What is Advance Tax?

Advance tax, also known as 'pay as you earn' tax, is the income tax payable if your tax liability exceeds ₹10,000 in a financial year. It applies to all taxpayers including salaried, freelancers, and businesses.

Who Should Pay Advance Tax?

- Salaried individuals (if they have other sources of income)

- Self-employed professionals

- Businesses

- Individuals with income from rents, capital gains, interest, and other sources

Due Dates for Advance Tax Payments

The due dates for advance tax payments for individuals (other than companies) are as follows:

- 15th June: 15% of the advance tax liability

- 15th September: 45% of the advance tax liability

- 15th December: 75% of the advance tax liability

- 15th March: 100% of the advance tax liability

Steps to Calculate and Pay Advance Tax

1. Estimate Total Income

Estimate your total income for the financial year. Include all sources of income such as salary, business income, interest income, rental income, capital gains, etc.

2. Calculate Tax Liability

Compute your tax liability based on the estimated total income. Use the current income tax slabs and rates applicable to your income.

3. Deduct TDS and Other Credits

Deduct the Tax Deducted at Source (TDS), tax credits, and any other prepaid taxes from your total tax liability.

4. Determine Advance Tax Payable

Subtract the TDS and other credits from your total tax liability. If the remaining tax liability exceeds ₹10,000, you need to pay advance tax as per the prescribed schedule.

5. Pay Advance Tax Online

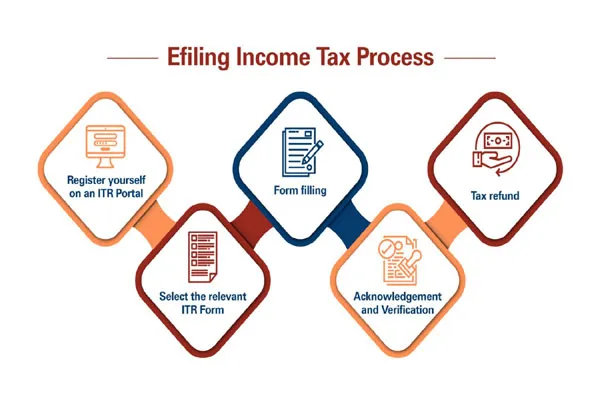

You can pay advance tax online through the following steps:

- Visit the NSDL website.

- Select the applicable challan (ITNS 280 for advance tax payment).

- Fill in the required details such as PAN, assessment year, address, and payment type (advance tax).

- Choose the bank through which you want to make the payment and proceed.

- Verify the details and submit. You will be redirected to the bank's payment gateway.

- Make the payment using net banking, debit card, or other available methods.

- Save the receipt or challan number for future reference.

6. Offline Payment (Optional)

You can also pay advance tax offline by visiting a designated bank branch. Fill in the physical challan form (ITNS 280), provide the required details, and make the payment at the bank counter. Ensure you receive a stamped copy of the challan as proof of payment.

Tips for Filing Advance Tax

- Keep Records: Maintain a record of all advance tax payments and receipts.

- Review Quarterly: Review your income and tax liability quarterly to ensure you are on track with your advance tax payments.

- Consult a Professional: If you are unsure about the calculations or payment process, consider consulting a tax professional.

Conclusion

Paying advance tax on time helps in avoiding interest and penalties. Ensure to estimate your income accurately and adhere to the due dates to stay compliant with the tax regulations in India.