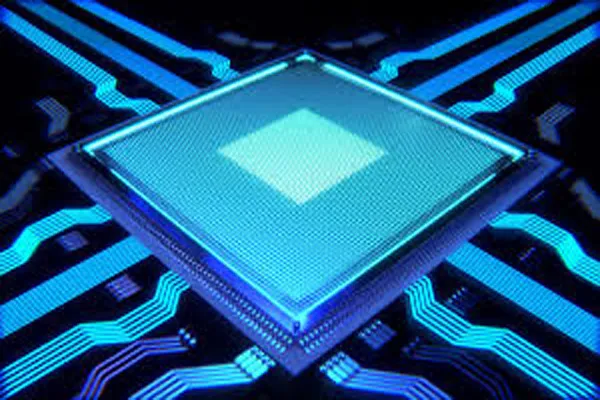

Taiwan’s critical role in the global semiconductor industry stems from a combination of historical, economic, and strategic factors.

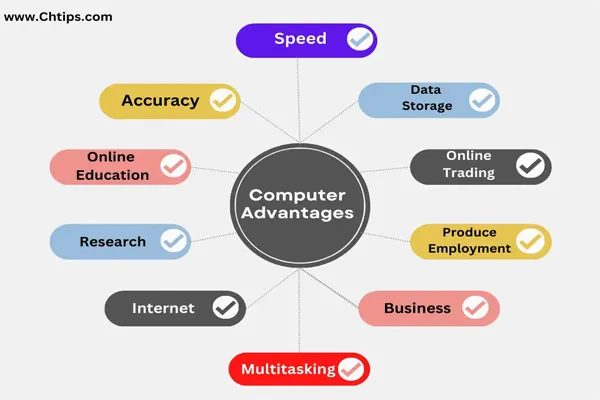

1. Dominance of TSMC (Taiwan Semiconductor Manufacturing Company)

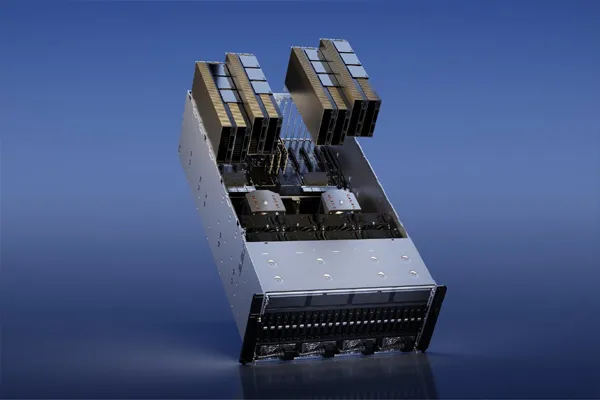

- Global Leader in Chip Manufacturing: TSMC is the world’s largest and most advanced contract semiconductor foundry, producing over 50% of the world’s chips by value. It manufactures chips for major companies like Apple, NVIDIA, AMD, Qualcomm, and Intel, which rely on TSMC for cutting-edge processors used in smartphones, computers, AI systems, and more.

- Technological Edge: TSMC leads in advanced process nodes (e.g., 3nm and 5nm chips), which are essential for high-performance devices. Its ability to produce smaller, more efficient chips gives it a competitive advantage over rivals like Samsung (South Korea) and Intel (US).

- Foundry Model Innovation: TSMC pioneered the "pure-play foundry" model, focusing solely on manufacturing chips designed by other companies rather than competing with them. This neutrality has made TSMC a trusted partner for global tech giants.

2. Concentration of Supply Chain

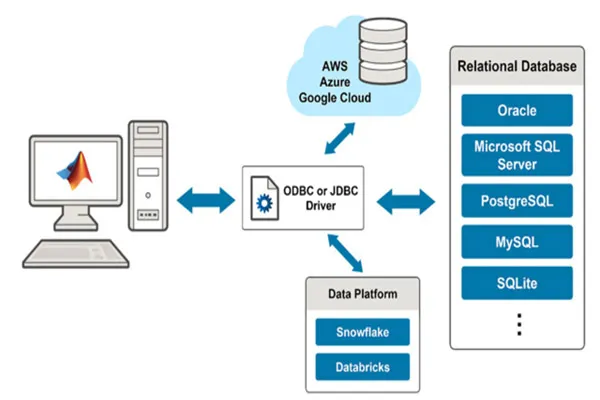

- Ecosystem Advantage: Taiwan hosts a robust semiconductor ecosystem, including chip design firms (e.g., MediaTek), equipment manufacturers, and packaging/testing companies. This clustering fosters efficiency, innovation, and cost-effectiveness.

- Key Players Beyond TSMC: Companies like UMC (United Microelectronics Corporation), ASE Group (packaging and testing), and others complement TSMC, making Taiwan a one-stop hub for semiconductor production.

- Proximity Benefits: The close geographic proximity of suppliers, manufacturers, and research institutions in Taiwan (e.g., Hsinchu Science Park) accelerates production cycles and reduces costs.

3. Global Dependence on Taiwanese Chips

- Critical for Multiple Industries: Semiconductors made in Taiwan power everything from consumer electronics (smartphones, laptops) to automotive systems, medical devices, and defense technologies. Disruptions in Taiwan’s chip supply could cripple global industries.

- Pandemic Lessons: The 2020-2022 global chip shortage, exacerbated by supply chain disruptions, highlighted Taiwan’s outsized role. For example, automakers like Ford and GM halted production due to shortages of Taiwanese chips.

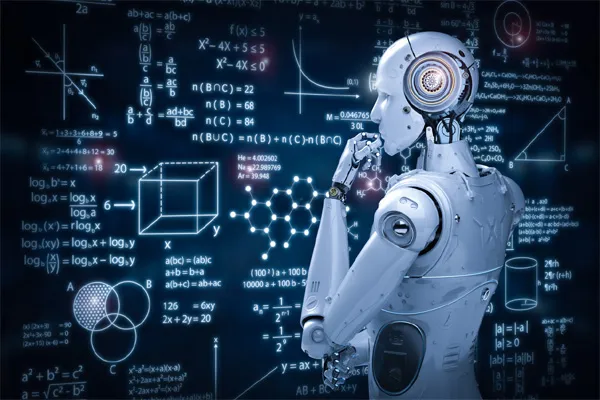

- AI and Emerging Tech: The rise of AI, 5G, and IoT has increased demand for advanced chips, where Taiwan’s expertise is unmatched. NVIDIA’s AI GPUs, for instance, are manufactured by TSMC.

4. Geopolitical Significance

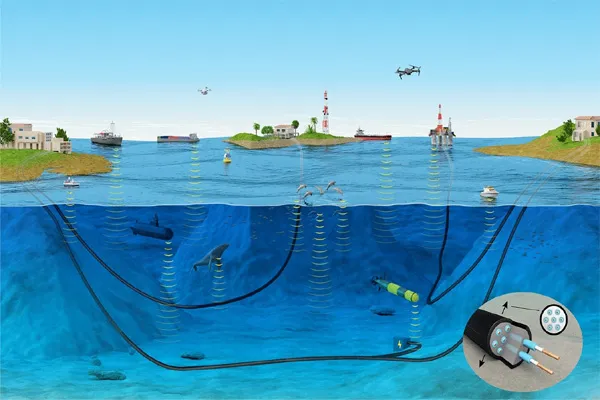

- Strategic Asset: Taiwan’s dominance in semiconductors makes it a geopolitical linchpin. Its chips are vital to the economies and national security of major powers like the US, China, and the EU. This has been described as Taiwan’s “silicon shield,” deterring aggression due to global reliance on its chips.

- US-China Tensions: Taiwan sits at the center of US-China tech rivalry. The US relies on TSMC for advanced chips, while China seeks to reduce its dependence on foreign semiconductors. Any conflict or disruption in Taiwan could have catastrophic effects on global tech supply chains.

- Efforts to Diversify: While the US, EU, and others are investing in domestic chip production (e.g., CHIPS Act in the US), building advanced foundries takes years, and Taiwan’s expertise remains unmatched for now.

5. Historical and Economic Foundations

- Government Support: Taiwan’s government strategically invested in semiconductors starting in the 1970s, establishing institutions like ITRI (Industrial Technology Research Institute) and spinning off TSMC in 1987. Subsidies, tax breaks, and R&D support fueled the industry’s growth.

- Skilled Workforce: Taiwan’s emphasis on STEM education has created a deep talent pool of engineers and researchers, sustaining its technological edge.

- Cost Competitiveness: Taiwan’s efficient manufacturing and economies of scale allow it to produce chips at competitive prices, even as costs for advanced nodes rise.

6. Challenges and Risks

- Geopolitical Vulnerability: Taiwan’s proximity to China and ongoing cross-strait tensions pose risks to its semiconductor industry. A conflict or blockade could disrupt global chip supplies.

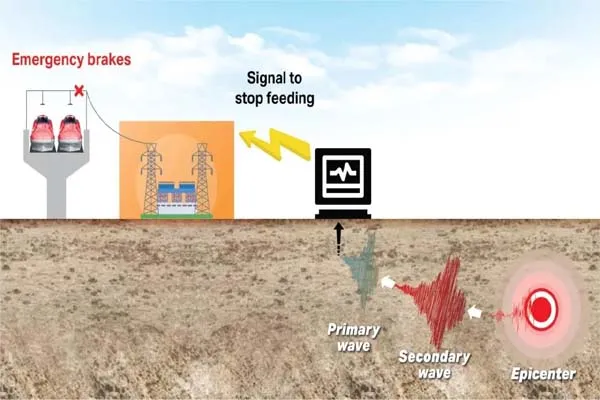

- Natural Disasters: Taiwan is prone to earthquakes, which can temporarily halt production. For example, a 1999 quake disrupted TSMC’s operations, causing global ripples.

- Supply Chain Fragility: The concentration of chip production in Taiwan creates a single point of failure. Diversification efforts (e.g., TSMC’s factories in the US and Japan) aim to mitigate this but are still in early stages.