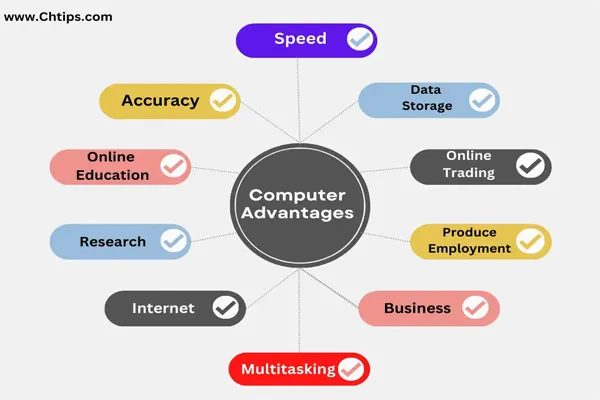

As the Goods and Services Tax (GST) regime continues to evolve, various new trends are emerging that aim to simplify the tax structure, ensure greater compliance, and improve the overall functioning of the tax system.

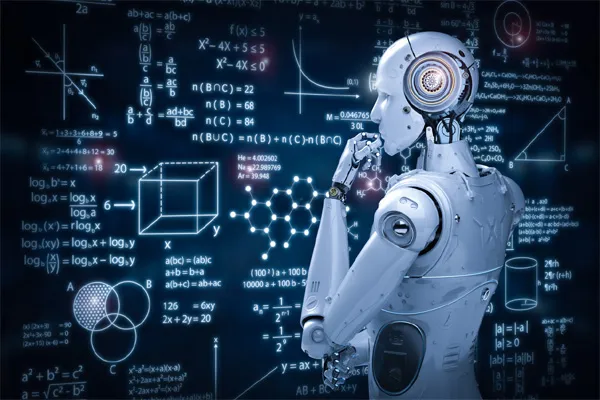

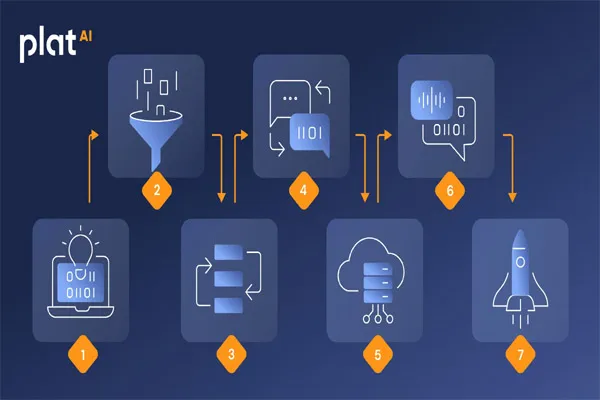

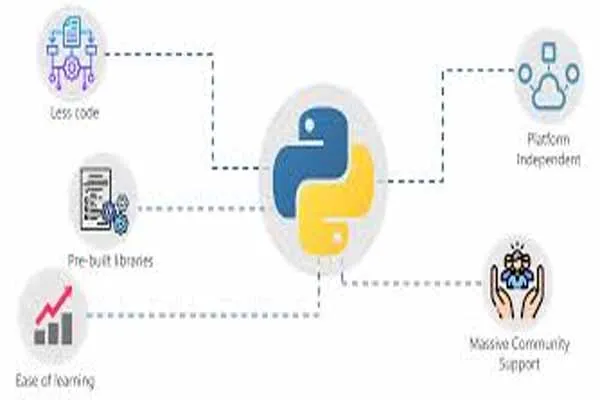

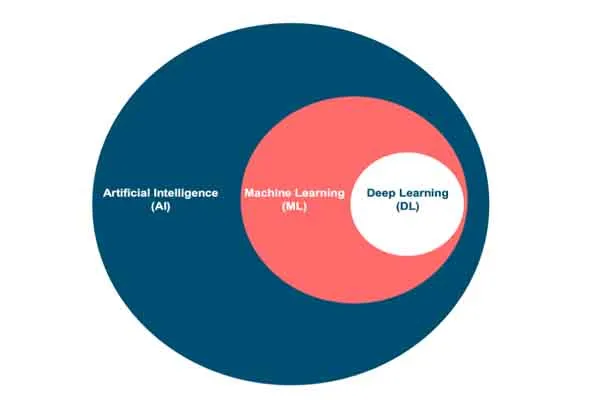

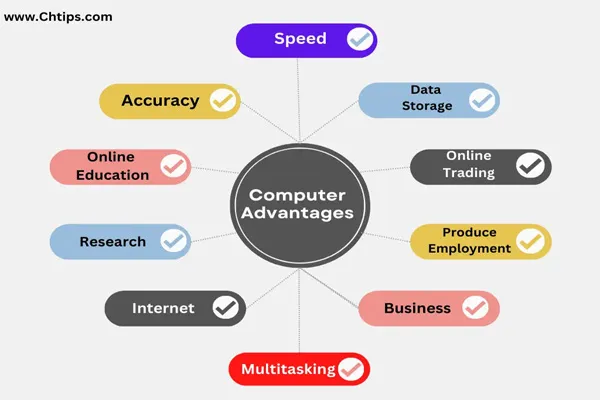

1. Technology and Automation Integration

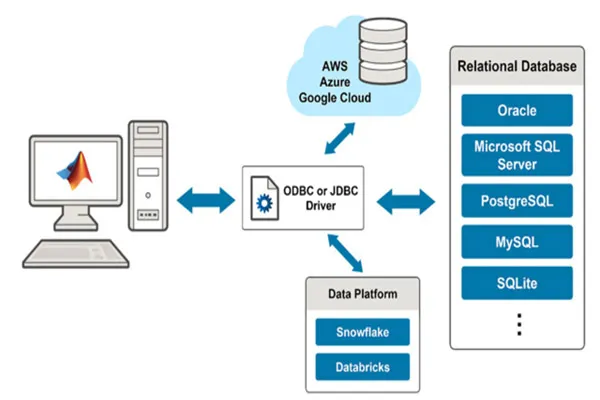

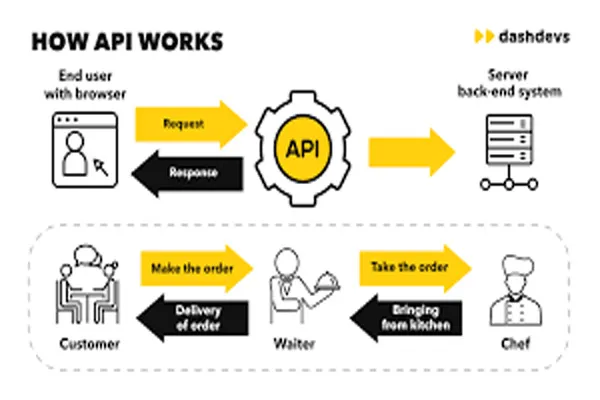

- AI and Machine Learning: The government is increasingly leveraging Artificial Intelligence (AI) and Machine Learning (ML) to streamline GST processes. These technologies help in better tax detection, fraud prevention, and data reconciliation.

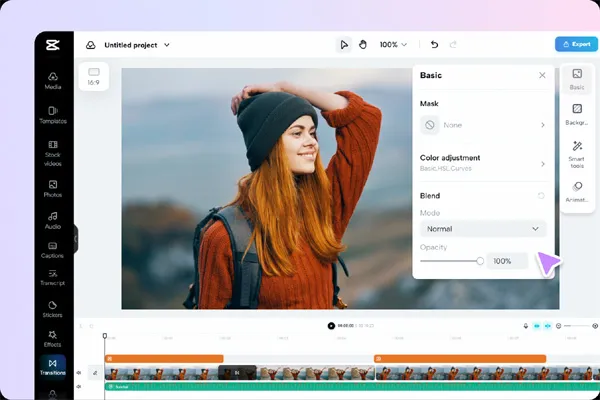

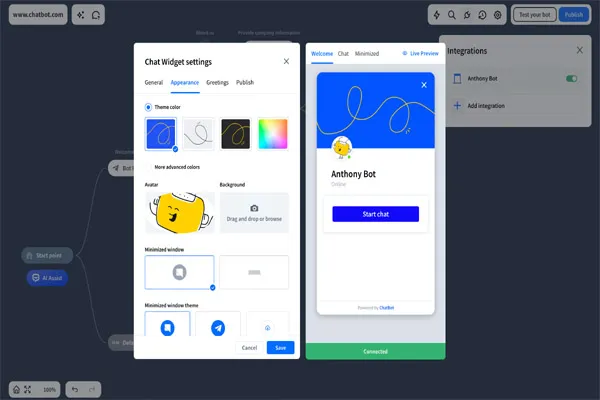

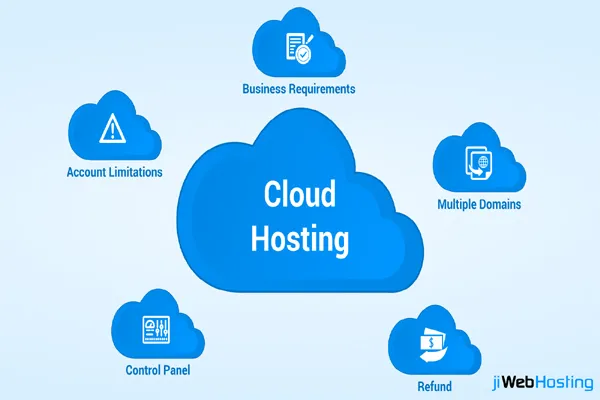

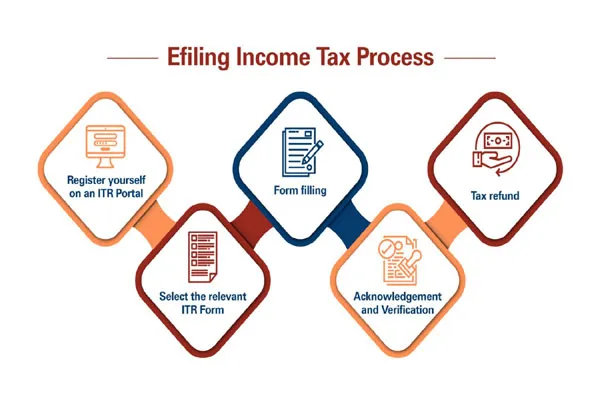

- GSTN Portal Upgrades: The Goods and Services Tax Network (GSTN) portal has undergone significant upgrades to enhance its functionality, making it more user-friendly. Features like e-invoicing, e-way bills, and auto-population of returns are becoming common, improving ease of doing business.

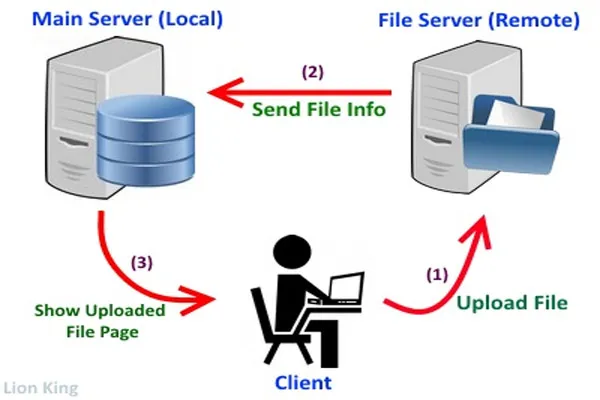

2. E-Invoicing

- E-invoicing, where businesses are required to generate invoices electronically, is becoming mandatory for larger businesses and is being expanded to include more taxpayers each year. This helps reduce manual errors, improves data accuracy, and speeds up the compliance process.

- The system facilitates automatic generation of e-way bills and timely reporting of tax liabilities.

3. E-Way Bill System Expansion

- The e-way bill system, which was initially introduced for the interstate movement of goods, has now been expanded to intra-state transportation as well, depending on state-specific regulations.

- Real-time tracking of goods, enhanced transparency, and reduction in tax evasion are some of the key benefits of this system.

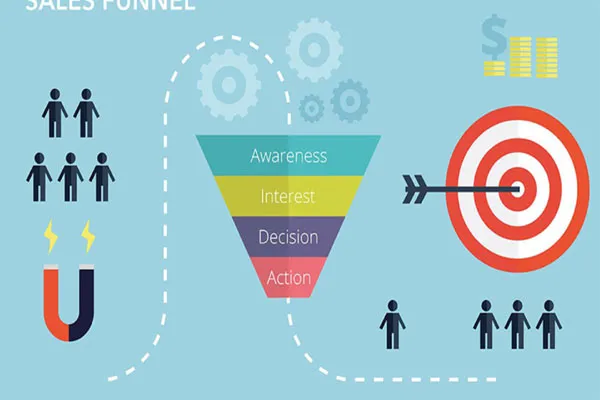

4. GST Compliance Rating

- GST Compliance Rating has been introduced to assess the compliance level of taxpayers. This rating helps businesses identify their partners’ or suppliers’ compliance behavior, assisting in better decision-making and reducing the risk of working with non-compliant vendors.

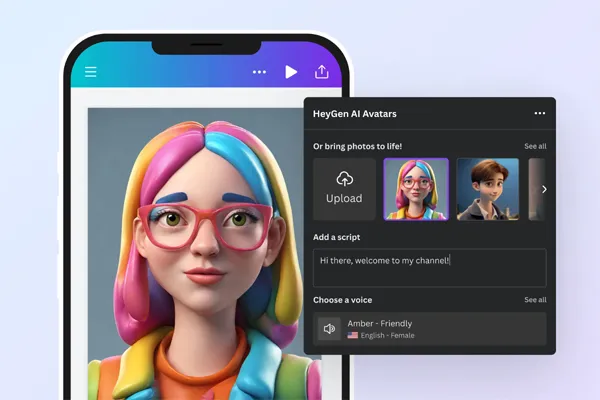

5. GST on Digital Transactions

- With the growth of digital payments and online business activities, the GST law has been evolving to address the taxation of digital transactions. A special focus is being placed on businesses offering services through online platforms, including e-commerce operators and digital service providers.

- Taxation of cross-border digital services and how international businesses are subject to GST is also an area of growing focus.

6. GST on Real Estate Transactions

- Real estate transactions have seen significant changes under GST. The tax treatment of under-construction properties, development rights, and leasing services is being fine-tuned, with the intent to create a more transparent tax structure in the sector.

- The introduction of tax on residential properties, such as on ready-to-move-in homes and affordable housing, has become a topic of discussion in the real estate industry.

7. GST on Import of Services

- There has been an increasing emphasis on the taxation of services imported into India, such as legal, consulting, or IT services. The changes aim to level the playing field between domestic and international service providers.

- A more uniform approach for foreign suppliers is being designed to ensure fair competition in the market.

8. GST Audit and Scrutiny

- There is a push toward more frequent and in-depth GST audits, leveraging technology to flag discrepancies in tax filings. Businesses may face greater scrutiny for under-reporting, non-compliance, or fraud.

- Continuous monitoring of transactions and tax returns has created an environment where real-time data analytics is crucial for identifying irregularities.

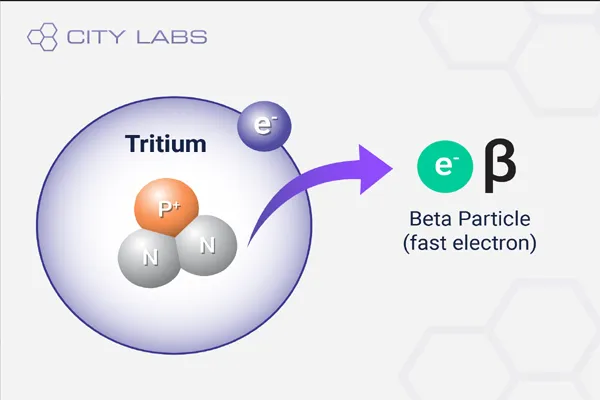

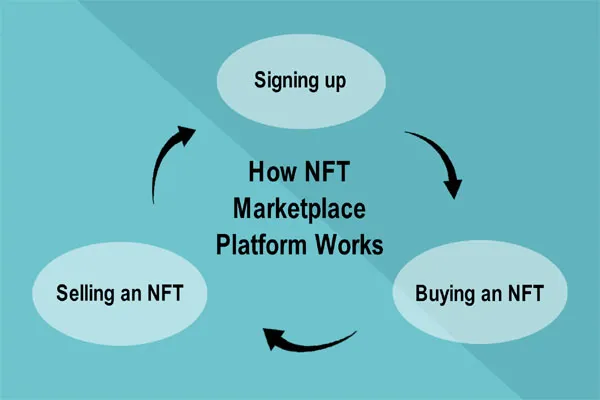

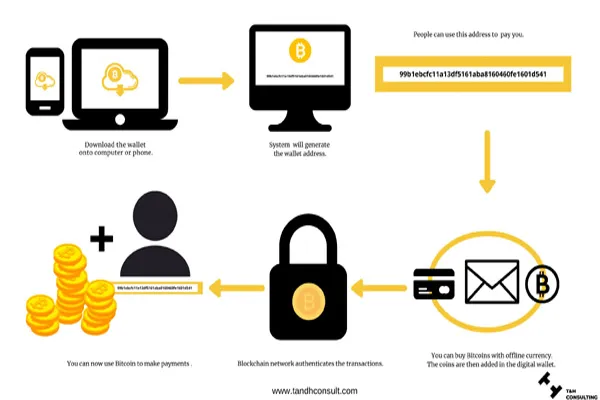

9. Taxation on Cryptocurrencies and Virtual Assets

- Governments worldwide, including in India, are closely looking at the taxation of cryptocurrencies, NFTs (Non-Fungible Tokens), and other virtual assets under GST. Although detailed regulations are still under development, this trend reflects the need to adapt the tax system to modern financial technologies.

10. Focus on GST on Exports

- Exporters are seeing significant changes in the way GST is applied to exported goods and services, including rebates, refunds, and input tax credit (ITC) claims.

- Simplification of GST refund processes, faster clearance for exporters, and a clearer system for claiming benefits have been trending towards boosting India's exports.

11. Single GST Rate Proposal

- There have been ongoing discussions regarding the possibility of a single GST rate across the country. While the current system uses multiple tax slabs, simplifying the tax rate structure could help businesses and tax authorities alike, especially when it comes to reducing compliance complexity and the scope for tax evasion.

12. GST on Rent and Lease Agreements

- The taxation of rental agreements, especially in the context of residential and commercial properties, has seen more clarity with regard to the tax implications under GST, especially for tenants, landlords, and real estate businesses.

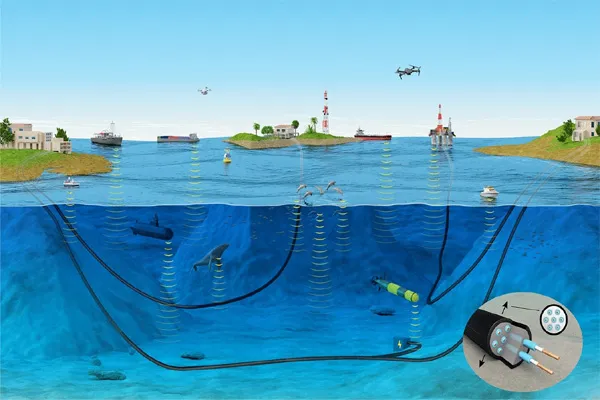

13. Cross-Border Trade Facilitation

- Increasing GST initiatives to facilitate smoother international trade have become essential. This includes customs and tax adjustments, as well as procedures for the seamless movement of goods between countries, especially with respect to export and import duties.