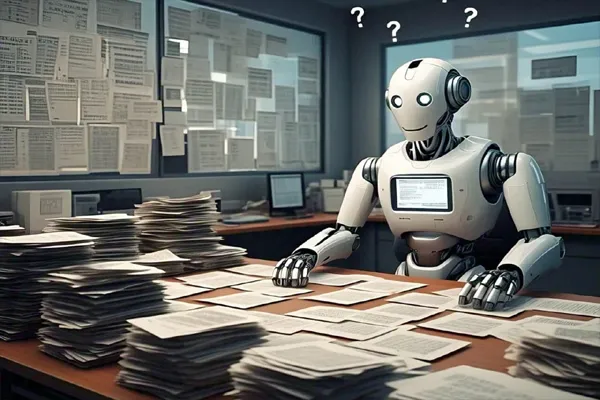

In India, ITR stands for Income Tax Return. It is a form used by individuals, companies, and other entities to report their annual income, and taxes paid or owed to the Income Tax Department. Filing an ITR is mandatory for individuals or entities whose income exceeds certain thresholds specified by the government. Here are some key points related to ITR in India:

- Types of ITR Forms: There are different forms (ITR-1, ITR-2, ITR-3, etc.) depending on the type of taxpayer (individual, HUF, company, etc.) and the nature of their income (salary, business income, capital gains, etc.).

- Filing Deadline: Typically, the deadline for filing ITR for individuals is July 31st of the assessment year (the year following the financial year for which the return is being filed). For businesses and entities requiring audit, the deadline is usually September 30th.

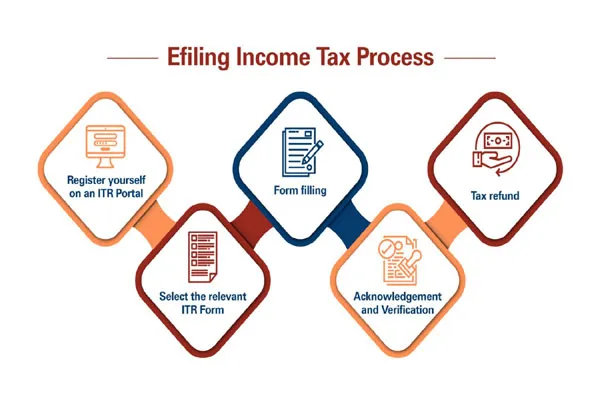

- E-Filing: Most ITRs can be filed electronically through the official Income Tax Department website or other authorized e-filing portals.

- Benefits of Filing ITR:

- Legal Requirement: Compliance with legal requirements.

- Financial Record: Acts as proof of income for various financial transactions.

- Tax Refunds: Necessary for claiming tax refunds.

- Loan and Visa Applications: Often required when applying for loans or visas.

- Penalties for Non-Filing: There are penalties for not filing ITR on time, which may include fines, interest on the due amount, and in some cases, prosecution.