1.Regulatory Compliance

- Import/Export Licenses: Many countries require specific licenses for certain goods.

- Customs Regulations: Compliance with the customs laws of both exporting and importing countries.

2. Documentation

- Commercial Invoice: Details of the sale between the buyer and seller.

- Bill of Lading: A contract between the shipper and carrier, serving as a receipt.

- Certificate of Origin: Verifies where the goods were manufactured.

- Packing List: Details the contents of the shipment.

- Export Declaration: A document submitted to the customs authority to declare goods for export.

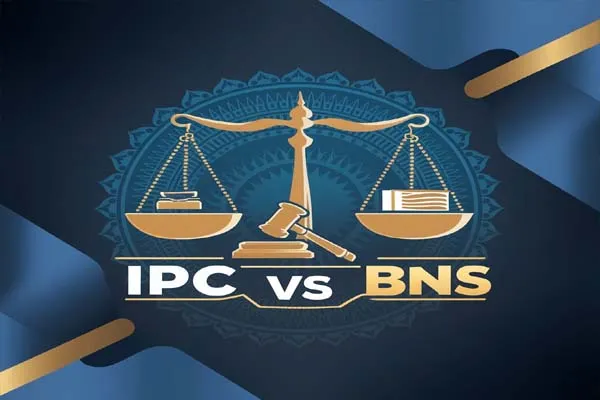

3. Tariffs and Duties

- Understanding applicable tariffs, import duties, and taxes that may apply to the goods.

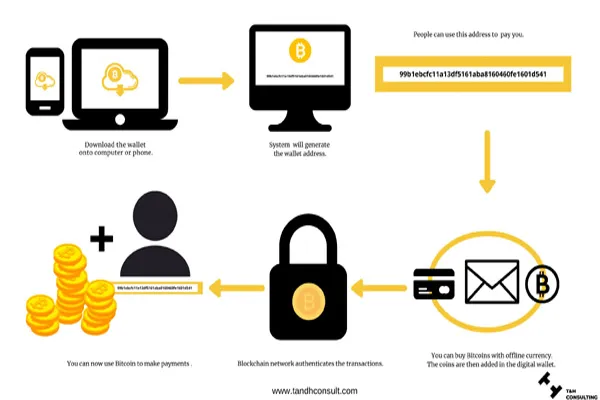

4. Payment Methods

- Selection of payment methods (e.g., letter of credit, advance payment) that provide security for both parties.

5. Insurance

- Arranging for appropriate insurance coverage for goods in transit.

6. Quality Standards

- Ensuring that products meet the quality and safety standards of the importing country.

7. Trade Agreements

- Familiarity with any applicable trade agreements that might affect tariffs or trade barriers.

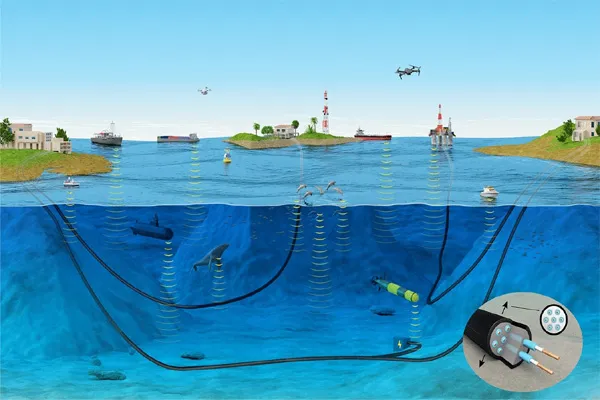

8. Logistics and Shipping

- Coordinating the transportation of goods, including selecting shipping methods and carriers.

9. Risk Management

- Assessing and managing risks associated with international trade, including political, economic, and currency risks.

10. Dispute Resolution

- Establishing mechanisms for resolving disputes that may arise during the trade process.