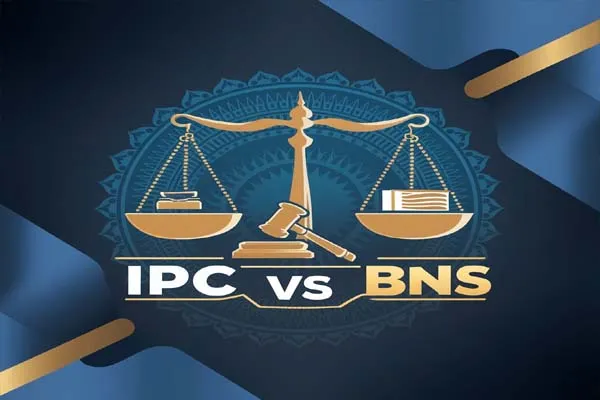

1. Business Structure Registration

- Sole Proprietorship: No formal registration required, but you may need to register for GST if your turnover exceeds the threshold.

- Partnership Firm: Register under the Indian Partnership Act, 1932. A partnership deed is drafted and signed.

- Limited Liability Partnership (LLP): Register with the Ministry of Corporate Affairs (MCA) by filing the incorporation documents.

- Private Limited Company: Register under the Companies Act, 2013. You’ll need to obtain a Certificate of Incorporation from the MCA.

2. Goods and Services Tax (GST) Registration

- If your business turnover exceeds ₹20 lakhs (₹10 lakhs for special category states), you must register for GST.

- Apply online on the GST portal and obtain a GSTIN (Goods and Services Tax Identification Number).

3. Permanent Account Number (PAN)

- Obtain a PAN from the Income Tax Department. It is mandatory for tax purposes and for opening a business bank account.

4. Tax Registration

- Professional Tax: Depending on the state, you may need to register for professional tax.

- TDS Registration: If you deduct tax at source (TDS), you’ll need to obtain a TDS registration.

5. Shops and Establishment Act Registration

- Register your business under the Shops and Establishment Act of the respective state. This registration is mandatory for any commercial establishment.

6. Trade License

- Obtain a trade license from the local municipal authority or government body to legally operate your business.

7. Import Export Code (IEC)

- If you plan to import or export goods, apply for an IEC from the Directorate General of Foreign Trade (DGFT).

8. Sector-Specific Licenses and Permits

- Depending on your business type, you may need specific licenses (e.g., food license from FSSAI for food businesses, pollution control license for manufacturing, etc.).

9. Company Compliance

- Regular compliance with the Companies Act is required for companies, including annual filings and maintaining statutory registers.

10. Trademark Registration

- Protect your brand by registering your trademark with the Controller General of Patents, Designs, and Trademarks.

Steps to Follow:

- Choose a Business Structure: Decide on the type of business entity that suits your needs.

- Apply for Name Approval: Ensure the name you choose is unique and compliant with regulations.

- Complete Necessary Registrations: Follow the procedures for each registration required for your business.

- Open a Business Bank Account: Once you have your PAN and business registration, open a separate bank account for your business.

- Comply with Labor Laws: If you hire employees, register under the Employees’ Provident Fund (EPF) and Employees’ State Insurance (ESI) schemes.

Conclusion

Starting a business in India involves navigating through various registration processes to ensure compliance with the law. It’s advisable to consult with legal and financial experts to ensure that all requirements are met and to facilitate a smooth registration process. With the right registrations in place, you can focus on growing your business successfully!